Everything you’re hearing about inflation is wrong. The conservatives are wrong, the liberals are wrong, the pundits are wrong, and the economists are only right very quietly and in ways that won’t get them kicked out of Paul Krugman’s cocktail parties. Only after years of being silent on what everyone in business has known for years have they come clean. The inflation is real, it happened, it’s bigger than what people claim, and it happened because of the Covid lockdowns.

Don’t blame the immigrants. Don’t blame “price gouging” corporations. Don’t blame the Kamala-Biden regime. Don’t blame Trump. If your groceries cost 25% more, blame the CDC. If you’ll never be able to afford a mortgage again because all the boomers and Gen Xers locked up the homes into 3% fixed rate 30-year mortgages, blame the CDC. If your children are high schoolers with brains melted by TikTok memes who can’t figure out how to use a ruler you can blame the CDC for that too, but this is an article about inflation so we’ll stash discussion of how the lockdowns were worse than the crack epidemic for later.

The inflation happened because everyone tried to buy two years’ worth of shit in one year.

Not “Transitory” and Bigger than Claimed

Fed Chair Jerome Powell said in 2021 that the inflation would be “transitory,” and the Biden regime adopted that word because it made it sound to the muggles like prices would go down later when they wouldn’t, because that’s not how inflation works. Powell, Yellen, and the economists probably used this language because they experience social benefits for aligning with the regime even when it means misleading (lying to?) the public.

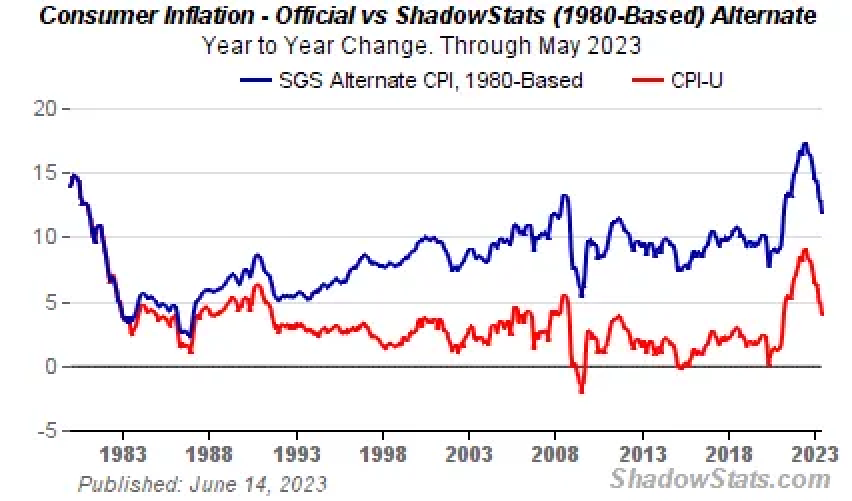

Economists still claim inflation “isn’t as bad as the 1970s” as a way to temper anger over it, but that’s not an apples-to-apples comparison. Inflation is measured by Consumer Price Index, or CPI, and CPI is a made-up equation to try and get a gauge on what’s happening to people’s wallets. Because it’s made-up, they can change how they calculate it, and the current CPI is not calculated the way it was in the 1970s. To compare inflation to the 1970s you’d have to use the same equation, and if you did so in an honest manner, the recent inflation was worse than the inflation we saw under Carter.

Realizing their error a year too late, the Fed jacked rates to tamp down the inflation, and that seems to have largely worked, even if it has priced an entire generation out of buying a house.

Not Gouging

Conservatives and angry bloggers saying grocery prices “have doubled” are exaggerating, cherry picking certain products for screenshots to try and farm clicks. But liberals saying the rise is small are also cherry picking, usually by looking at the year on year increase instead of the increase since 2020. In truth, grocery store prices on net are about 25% higher, and this is not due to Kroger “price gouging” as this mentally deficient Newsweek article claims.

Kroger’s gross revenue in 2021 was $132 billion, and their net income was $2.6 billion. “Billion” sounds like a lot to a muggle but that’s only a 2% profit margin. Even if Kroger doubled their profit margin, which they didn’t, that would only change their gross revenue by 2%, less than a tenth of the grocery store cost spike. Anyone who claims that grocery store inflation is due to greedy rich corporate price gouging needs to be hit with the arithmetic bat repeatedly until they’re back in a 3rd grade desk learning how to divide numbers. We can start with this lady.

After she’s settled into 3rd grade math class, she could save a seat for Robert Reich.

Monopoly Money

Modern conservatives repeatedly claim that dumping $5 trillion worth of monopoly money out of helicopters in 2020 caused the inflation. This is partially correct, but it’s important to put this in historical perspective. The Ron Paul Kids have been saying for decades that deficit spending will cause inflation. The Keynesians reply “no, you can print money as long as the economy grows commensurately with the money printing.” This argument has been going for years, with no resolution, because the Keynesian premise is difficult to test. Economics is a field where theories are mostly untestable in a scientific sense, because there’s no good way you can simply set an economy aside and do wild wacky shit with it to see what happens.

Or so everyone thought.

Lockdowns

I used to be a Ron Paul kid. After 2020 I’m a Keynesian. 2020 was essentially a laboratory test of Keynesian theory which was roundly ignored by the Keynesians because they wanted invites to Paul Krugman’s cocktail parties. Let me explain. In March 8 2022, HWFO published this article, which I encourage you to read:

In summary, Keynesians think that the cost of goods is essentially the (amount of money in a system) divided by (the amount of stuff to buy) in a system. Systems are big and complicated, so that article shows how this works with a hypothetical example of an island whose entire economy is hamburgers. You can cause inflation by introducing more money into the system, growing the numerator, which is usually the only knob the government has to manipulate inflation. But a truly evil awful disgusting idiot might also cause inflation by reducing the amount of stuff to buy in a system, shrinking the denominator.

In 2020, we ran the full experiment. We not only grew the numerator with $5 trillion worth of empty stimulus checks, we also shrunk the denominator by locking down the economy. Then in 2021 we said “OK WE’RE DONE, GO!” and everyone in the country tried to buy two years’ worth of shit in one year.

Conservative business owners whined and complained that “nobody wants to work anymore.” Remember that? That’s because there was two years worth of demand, and no possible amount of labor available to meet that demand. The business owners couldn’t staff up to meet demand because other business owners were also doing everything they could to scoop up the staff, and the wages rose, and the Fed got caught completely flat-footed when their “transitory” inflation stuck because of the higher wages.

They waited a year to hike rates because they thought it would go away, because apparently they go to political cocktail parties instead of business cocktail parties. Everyone in business was talking about this in 2021. I know I was. I have a friend who sells cable to power companies. In 2021 he was writing contracts to deliver cable that said “by the way we can deliver this cable to you any time within the next year and we can change the price of the cable the day before it’s delivered to whatever price we decide we want to charge you,” and the utilities were signing the contracts because they had no choice, because they needed the cable that badly. This sort of absurdity was going on everywhere, because everyone across all business domains was trying to buy two years worth of shit in one year.

Only in 2022 did people start saying “the inflation is demand driven,” and only in January of 2023 was it finally politically feasible for the Fed to quietly admit what was going on. This post in Monthly Labor Review, referencing this working paper by the National Bureau of Economic Research lays it out. Labor market tightening and backlogs of orders for goods and services drove the inflation, combined with the $5 trillion of monopoly money. We ran the Keynesian experiment, which every good Keynesian should have said up front would cause absurd inflation, and the Keynesians kept quiet because they politically approved of the lockdowns because they didn’t like Trump and didn’t want their wives to throw them out of the house without a three month supply of surgical masks.

“Yes but my buddy just got laid off.”

“Yes but I just got laid off.”

Yeah, I feel you. My brother got laid off this week. That’s what happens when it takes three full years to churn through the demand backlog from the weird “go buy two years worth of shit in one year with funny money” event. When the backlog is finally caught up, suddenly you don’t need unusually large amounts of labor, you need normal amounts of labor, which means less than you needed in 2021, which means layoffs. Blame the CDC.

In 2019 I opposed the Keynesians. By the end of 2020 I was the only true Keynesian left, and when I tried to warn them of the coming inflation they called me a racist. So I sold my house, banked the equity, bought a new one on a 30 year fixed rate loan around 3% APR, moved to a county with an open school system during Covid Fall, and locked myself into the new CDC Economy knowing everyone else was going to be fucked.

Good luck buying a house, because I’m not selling mine in the CDC Economy. My interest rate is pre-lockdown, my eggs come from chickens, and it doesn’t matter who you vote for unless they’re willing to nuke the CDC before Covid-20 hits.

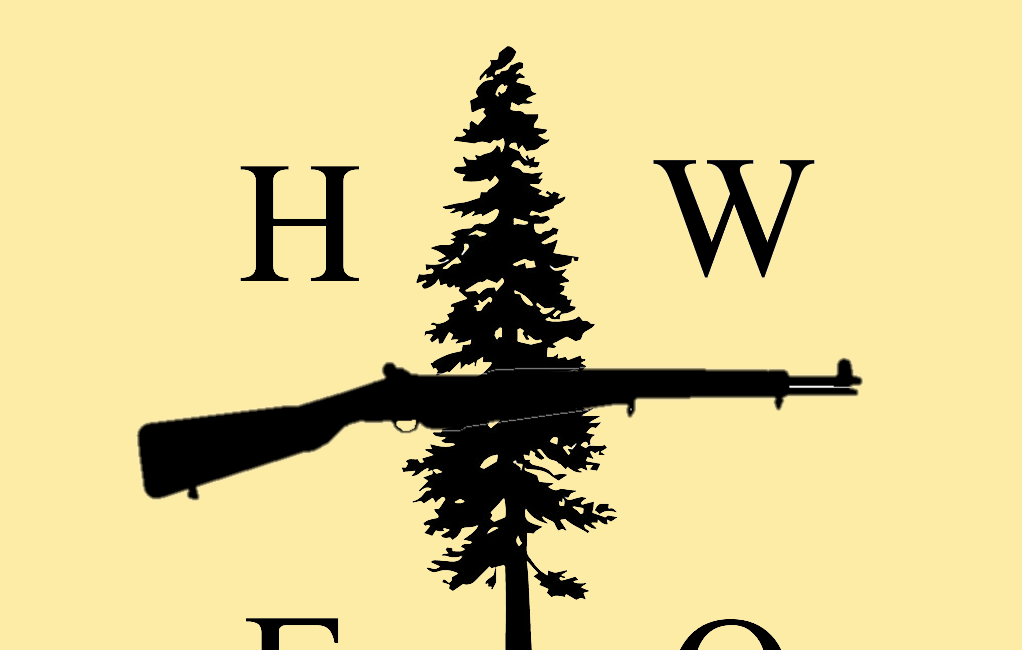

HWFO Slack, which you can join by subscribing, has some additional opinions:

Argh! I managed to predict and come out on top of 2008, the Iraq War economic issues and many others. But I read too many plague novels in college and got totally caught up in the COVID panic, and now earn half as much with higher bills.

(Look, a 1% fatality rate for a disease that can’t have a sterilizing vaccine that re-infects pretty much everyone 2-3x per year would destroy the economy in just a few years. Turns out it just took a 0.1% fatality rate and terrible leadership.)

We might, on the other hand, think about nuking the Fed. The Governors of the Federal Reserve made all of the stupid decisions regarding “quantitative easing” - shorthand for “Let’s imitate 1920’s Germany.” I know Germany’s problems weren’t that simple; there were a lot of factors at play. But both countries made equally bad choices about how to muck about with the money supply. If anyone wants to put some Deep State actors against a wall, I’d have to nominate that crowd as early adopters.