Burn the Universities and Salt the Earth

The real student loan debt problem, and its real solution

Gen Xers and Boomers need to understand that the Millennials have a right to be angry about their student loan debt. The Millennial generation was lied to by every person they trusted, every authority figure, every parent, teacher, guidance counsellor, college professor, college administrator, and politician. A combination of good intentions and horrible systems analysis created a vicious giant which ground their bones for its bread and shit their futures out of its bowels after digesting them, leaving them indebted husks of no additional value than when they left high school. No greater scam has ever been perpetrated against a single generation like the scam that is the entire higher education system in the United States, and there will never be reparations for this scam because the people calling for the reparations don’t even realize how complicit they were, or how deep the problem is. Absolving student loan debt wouldn’t even come close to fixing the problem. The problem is so bad, so deep, so rotten, that the only fix is for all higher education to burn. Herein, we will expose every detail of the scam, breaking down the anatomy of The Giant. We will make a case that the destruction of higher education is not only preferable, but it is inevitable, and is already happening, and we will all soon get to watch it transpire.

The American Royalty of Merit

Historically, the United States social caste system mirrored that of European nobility, albeit with more and varied nobles and a more fluid boundary between the nobles and the plebeians. Political power players within the cities and towns of the USA came from families who were granted land first in the spin up of colonialism. As the land increased in value their familial wealth spun up as well, and they became the people for whom town squares or big roads were named. As a landowner, you married your daughter off to another landowner to make sure the wealth didn’t get watered down. Cotillion, and manners, and high society, and debutante balls, and such, were a way to filter out the dregs and maintain wealth concentration by pair bonding the rich to the rich. Act Like Nobility to Stay Rich. This was simply a broader mapping of the European wealth concentration model.

As the country matured, its population grew, and its economy evolved from agriculture to manufacturing and the bourgeois city dwellers entered the upper echelons of society. Once college became liberalized and women could attend, the colleges and universities pivoted over to serving the same purpose as cotillion. Entrance to college was predicated on the ability to pay, so it created a boundary where the rich could court their children to other rich people, the wealth stayed concentrated, and everyone vacationed on Martha’s Vineyard. Liberal arts programs in major universities issued hobby degrees to women who would be taken care of economically by their newly found husbands, or hobby degrees to men who would inherit the family business. Outside of doctors, lawyers, engineers, and accountants, nothing of economic value was taught, but university attendance was still mandatory to stay rich, because the university was not merely a place of knowledge, it was the 20th century equivalent of a networking and dating site for rich people.

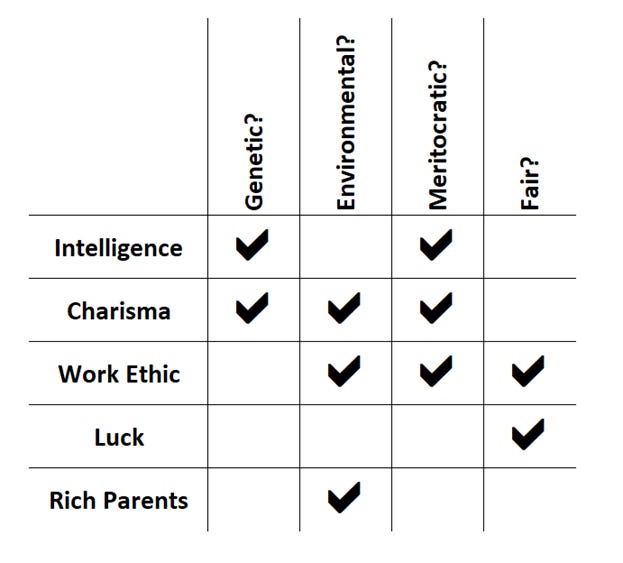

None of this was ever fair. As we’ve discussed before, there are actually five different contributing factors to economic success in the USA, not one. Some of these are meritocratic, some are fair, some are both, and some are neither.

For many years, “Attended a University” was a signal for these factors of success. Getting into college was a signal of intelligence, getting out was a signal of work ethic, and being able to pay for it was a signal of having rich parents. And so, on a bivariate analysis, every indication showed a strong correlation between attending university and being financially successful. But unless you (a) attained the doctor/lawyer/engineer/accountant degree and also (b) used that degree specifically to go into that field, the university didn’t actually create the success. It was just a signal that you had several of the success factors in the grid, and a social club to network to others with similar grid alignments.

The Giant’s Right Arm

We can debate the actual dates, but the dates don’t matter. At some point some well meaning people started to realize that there were folks in the underclass who were intelligent, charismatic, with work ethic, who could have absolutely been doctors or lawyers or engineers if they had the proper education. They merely lacked the Rich Parents signal. The country would be obviously stronger if these potentially successful poor could be pulled on-line into more successful, rewarding, higher paying jobs. For many years the function of pulling these people online was handled case by case by universities with academic scholarships, or needs based scholarships, individually. But the number of people granted these were still small, and most university attendees were still of the rich class utilizing the university for its original function – social networking with other rich people. Legacy wealth remained concentrated within descendants of rich parents, which skewed white for historical reasons. The data in isolation seemed as if everyone who goes to college makes more money, because correlation got confused with causation. It was true that the diploma carriers made more. It was not necessarily true that the diploma was why. Enter the single greatest sham of our lifetimes – the federally backed student loan program.

Somewhere at some point some useful idiot came up with the idea of giving anyone who wants to go to college a loan, regardless of their ability to pay it back, on the understanding that the diploma itself would convey enough value to them that they would be able to earn more and pay back the loan. This useful idiot confused correlation with causation, assigned a value to a piece of paper that the paper didn’t necessarily convey, and presumed that if every person in the country got a college degree they would all get a college level job, everyone would be richer, and everyone could pay back the loan.

This useful idiot did not consider the fact that handing out more degrees does nothing to change the job profile of the United States. The job market still needs just as many garbage men and ditch diggers and baristas today as it did thirty years ago, it’s just now the baristas have college degrees and debt. The federally backed student loan program did achieve its objective. There are doctors, lawyers, engineers, and accountants today who come from poor backgrounds and made their way because of student loans. But because of the way the useful idiot set the program up, their success is on the backs of the rest of the indebted poor.

This useful idiot was not one man, but rather fifty years of all of us, involving dozens of laws and changes to those laws, going back to 1956. Half a century of useful idiots who all confused correlation with causation, building the giant that exists today to eat Millennials and grind their bones to make its bread. But the useful idiots in government who provided a vehicle for permanent debt to acquire a mostly valueless piece of paper are only half of the beast.

The Giant’s Left Arm

In the United States, we fund public grade schools with property taxes. Property taxes are based on property value. Therefore, public schools near higher value property get more money, and therefore provide better educations. But that’s not the full picture.

Intelligence is largely a heritable trait, and in a technocracy intelligence earns you more money, so children who live in higher property value areas are likely to be disproportionately more intelligent. A disproportionate number of students who are inherently more intelligent, and who also have none of the environmental disadvantages that poorer people have, will perform better in school. The schools in more affluent areas seem as if they’re doing a better job of educating their students, when in fact educating students is easier for them because of who their students are.

Home buyers look very closely at the school rankings of an area before they buy a home in that area, because the school ranking is, in their mind, an indication of how well their children will be educated. The wealthy move to live next to the wealthy, the intelligent move to live next to the intelligent, and the country segregates itself along the boundary lines of public-school districts.

The guidance counselors and administrators realize this. Any student who chooses not to pursue college reduces their school’s ranking, which in turn reduces the property value, which in turn reduces the amount of money the school gets from property taxes. The incentive structures that fund the schools funnel all grade school administrative decision making into increasing the total number of children that go to college. Even the elected school boards themselves are complicit because they are property owners and want their own property to go up in value.

And now we see the second arm of the ghastly giant at the top of the beanstalk. The first arm is the politicians providing the vehicle for permanent debt to acquire a mostly valueless piece of paper. The second arm is the parents, teachers, administrators, school board members, real estate agents, and high school guidance counsellors all pushing kids to take on debt to get the mostly valueless paper, because the kid making that decision causes their property value to increase. And the kids are too young and too naïve to consider that every single person they encounter in their grade school life, from parents to teachers to administrators to peers, are lying to them.

Chopping Down the Beanstalk

Every element of this vicious monster was created by a well-meaning person who thought they were doing the right thing. Every person involved in it today – teachers, parents, politicians, administrators, real estate agents – is disincentivized to fix the problem. They don’t even realize they’re part of the problem. And none of them can change their behavior because of the game theory of the thing. If I choose not to send my kid to college then my kid doesn’t have the piece of paper, putting him or her at a competitive hiring disadvantage against the other kids with the piece of paper, and we are all in the same collective trap that no individual action can break. And in a stagnant world without social change, this trap would stay laid, forever. Thankfully we do not live in a stagnant world.

In 2005 Sal Kahn started a YouTube channel to tutor his cousin in mathematics. It went viral, grew, and now the Khan Academy provides a free way for anyone to learn math, its curricula growing. Chop.

Also in the 2000s, universities such as Stanford and MIT started migrating class content online, so anyone can sit at a computer, or even a Roku TV, and learn university level content without getting the degree. These universities still held on to the piece of paper, that paper being the value signal you actually buy. Education scaled, but they held back the signal in order to maintain their revenue stream. Chop.

In 2014, Georgia Tech popped this bubble with the OMSCS – a legitimate, real, online masters degree in computer science for a price tag of around $7,000. They can issue the course that cheaply because of economies of scale, and because the campus isn’t necessary for the education. Chop.

In 2020, every white-collar business and college in the country pivoted over to distance work and distance learning because of Covid-19. This was arguably going to happen over the next decade anyway, but fear of germs caused it to happen in a year. As colleges struggle to reopen during Covid, students who are used to distance learning anyway struggle to understand why they have to pay exorbitant tuitions for a campus they never see, nor in fact need in any way, if their goal is to get the piece of paper. Chop.

A wealth of free code boot camp options have erupted in the past two years, where you can receive every necessary educational element to become a computer programmer at no cost, the boot camp helps place you in a job, and then you pay them on the back end as a portion of your salary. No debt is ever accrued. Chop.

All of these things contribute to undermining the absurdity that was and is the university system. All most people care about with college is having a diploma to act as a hiring signal for their first job, and as the alternatives to paying a quarter million dollars for the campus experience proliferate, the rates of kids choosing expensive campus life will continue to fall. Technical schools such as Stanford and Georgia Tech will continue to have success because in-person education is of value to their students. Ivys will continue to have success because they will continue to serve the original function of American universities – dating and social networking among the rich. The rest of the colleges, commuter schools and exploding middle tier state schools built entirely on the backs of student loan debt, will fail. Their campuses will empty out, their facilities will collect dust, their football stadiums will be empty, and the beanstalk built on the backs of the indebted poor will come crashing down. The giant will die, and all the people whose livelihoods depend on the scam – liberal arts professors, diversity officers, administrators, pay for play academic journals, textbook publishers, and such, will have their bones shattered when the falling beanstalk breaks their back. And this is how it should be.

The millennials may never get their debt absolved. But Generation Z, Generation Alpha, and whatever we call the next bunch of yahoos getting born will have ways to avoid it. They will pop popcorn and do Tik Tok dances while catching their classes on Youtube, nabbing their mostly worthless piece of paper on the cheap instead of on the loan, and go be part of the gig economy without the burdens of their parents.

The giant’s death will be glorious, and well deserved.

Another aspect of this I will sometimes hear people argue: Griggs vs. Duke Power made it essentially illegal for companies to IQ test prospective employees. Therefore, companies require the expensive university degree signal to ensure a reasonably intelligent workforce.

As far as I know, the US military is still exempt from this requirement, and if you ace the ASVAB you might end up running a nuclear reactor on an aircraft carrier (which seems pretty high stakes!) without a college degree, whereas companies making the latest DoorDash clone require college degrees for people messing around with CSS files.

Increasingly, at least amongst companies in deep blue-tribe areas and industries, e.g. Silicon Valley, I also think the college degree requirement is a useful filter for the kind of cultural conformity being demanded at these places. If you can make it through an average four-year on-campus degree, you either weren't culturally red-tribe in the first place, or you quickly learned which opinions you couldn't express out loud without social censure, and will fit right in.

I attended at top liberal arts college from 1987-1991. The annual cost of tuition + room/board at the time was about $16,000/year, which was considered expensive. Through grants, work study, summer jobs, and parent contributions, I had about $25,000 in debt when I graduated.

I managed to pay off my debt by the time I was 25.

Today, my alma mater costs $74k per year.

There is absolutely no way I could ever recommend anyone attend in good conscience today.

I am a big believe in Stein's Law: If something can't go on forever, it won't.

Academia has set itself up for collapse.

- Tuitions are unaffordable.

- More schools are publicly declaring themselves institutions of advocacy, not education.

- Grade inflation has devalued the educational outputs of a university.

- There are too many free or low cost alternatives available for someone to gain knowledge.

- Universities continue to focus more on underpaid post-docs for instruction, undermining the whole point of in person learning from the best in their field.

Prices keep going up, yet every other trend should be pushing for reducing costs.

In a world where knowledge is free, and seemingly given a value of zero, the ONLY value of a college education is that of a luxury brand.