87,000 Racists

Analyzing the structural behavior of the IRS and comparing to modern emergent redefinitions of the term 'racism.'

The Inflation Reduction Act took it on the chin a week ago with lots of people sharing a not totally true yet not entirely false either statistic that the bill included provisions to hire 87,000 new IRS agents, and that those IRS agents would be targeting the poor. Let’s unpack this with maps, explain why the maps look like they do, and cross-reference those against the emergent “systemic racism” concept within the modern American left, to see what we can discover.

Maps

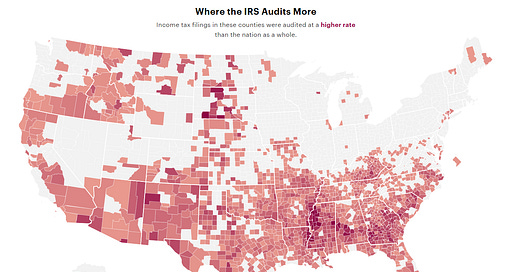

ProPublica, an emergent investigative journalism outfit that tends to run counter-narrative in both directions at times, published an analysis in 2019 showing a map of disproportionate IRS audits.

The first thing to notice in this map, is basically none of the coastal elite liberal centers are being audited disproportionately. Nothing north of the Mason Dixon line, nothing in the denser Pacific Rim population centers, and nothing in the blue areas of the Midwest. So that feeds the red tribe paranoia that they’re being disproportionately targeted by government institutions, and may feed an internal blue tribe narrative that they’re the ones who follow the law and those evil red tribers are breaking it and need to be punished for doing so.

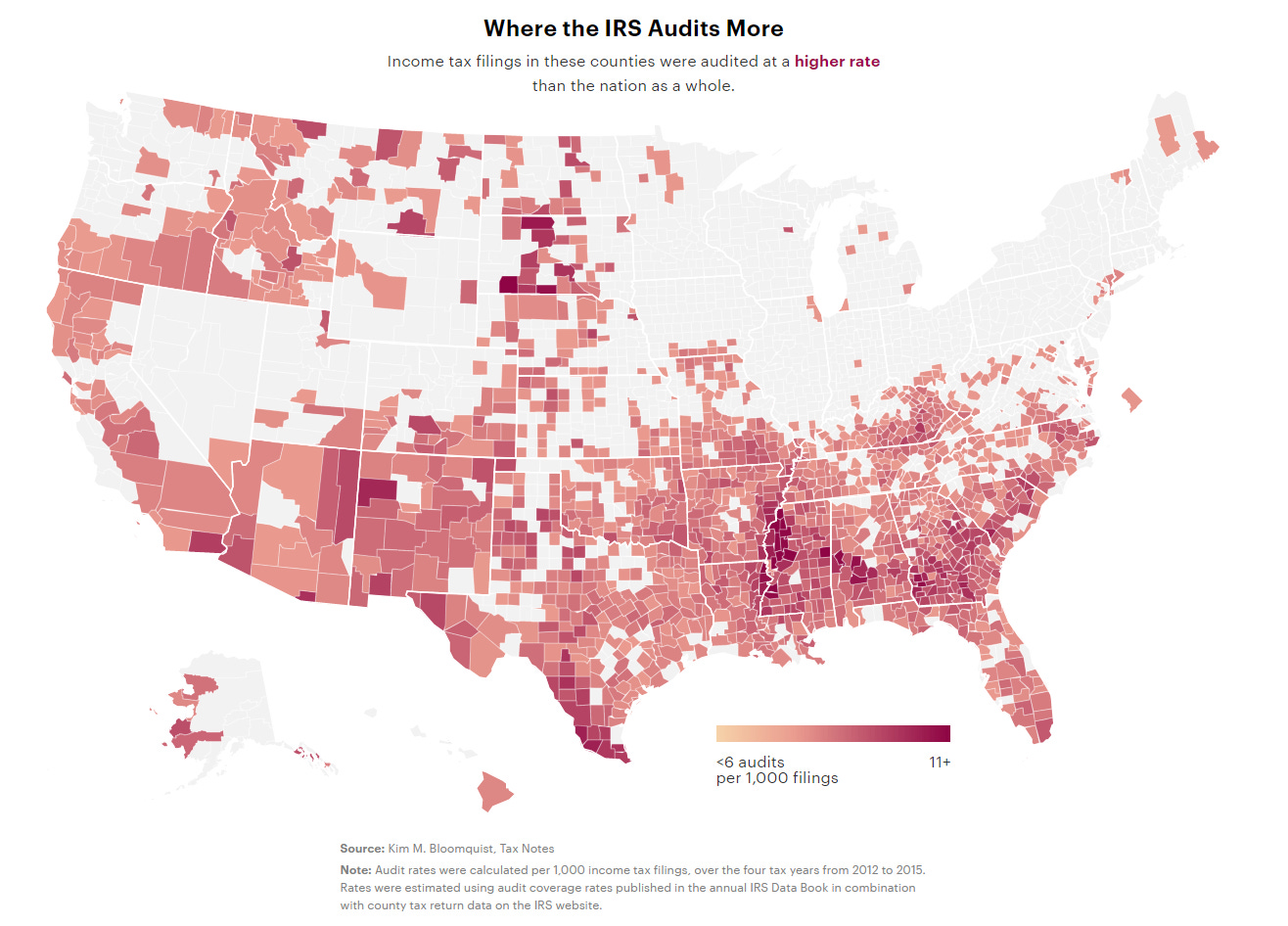

But that’s not what’s happening at all. We can also cross reference this map against a map of disproportionate racial demographics in the United States and see an almost perfect overlap. The Brookings Institute published a study, also in 2019, where they mapped disproportionate minority representation by county.

Comparing these two maps, there is an almost perfect overlap. It is apparent from comparing these two maps that either nonwhites are targeted by the IRS more than whites, or that living near a non-white causes you to be targeted more. I can’t believe the second explanation is true, given how race isn’t part of your 1040 form, which means the first explanation is far more believable to me.

There are only really a couple of spots where the overlap isn’t perfect. Southern Kentucky and northern Tennessee are white areas that get audited, and Nevada is curiously a disproportionately less white area that doesn’t for some reason.

Is there a better explanation? It turns out, yes.

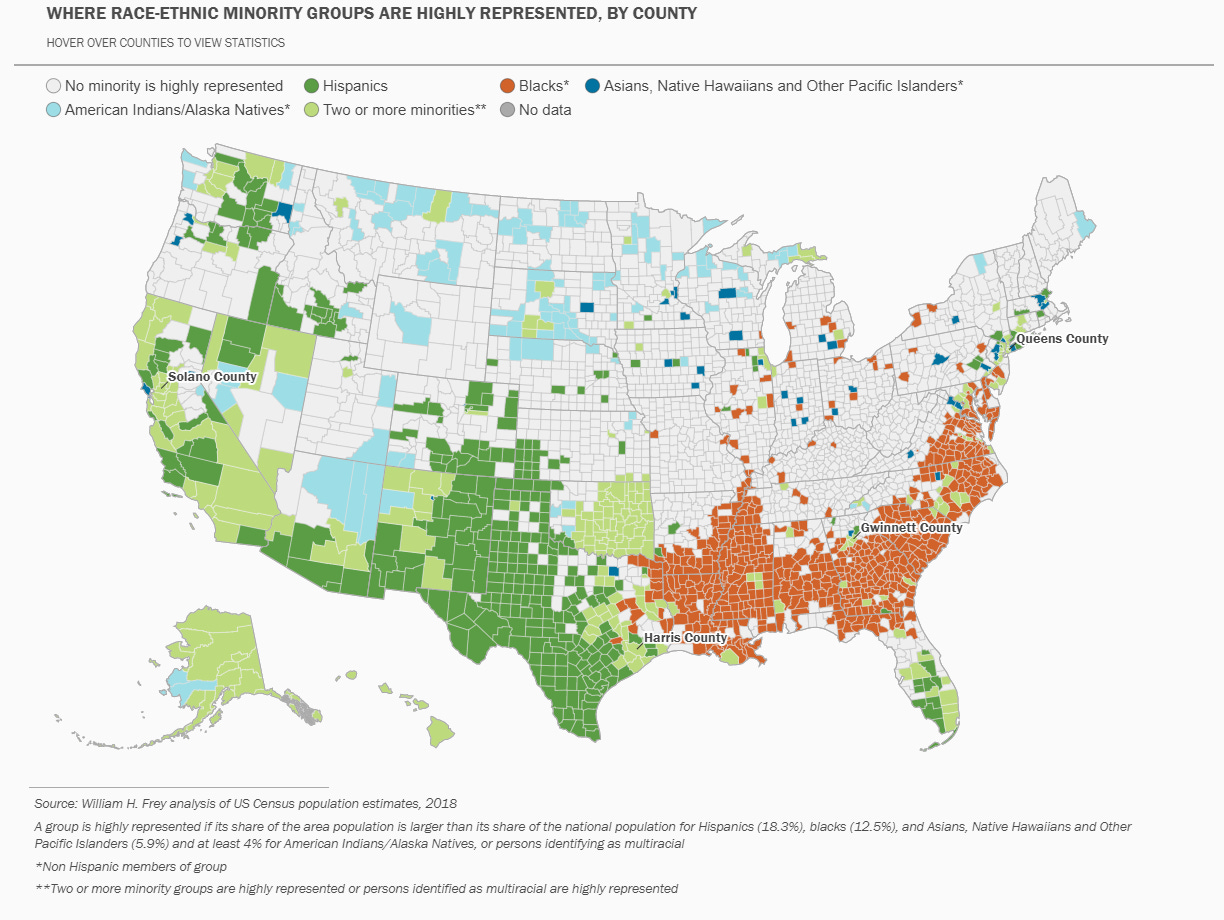

The Transactional Records Access Clearinghouse (TRAC) at Syracuse University gathers information about federal spending and does data processing on them, and has a page that ties all of this disproportionate enforcement to the Earned Income Tax Credit, or EITC. The EITC has an interesting history. It dates to 1975 and was expanded tremendously by Ronald Reagan, as a kind of reverse welfare or progressive tax where poor people who work get to keep more of their money. While conceptually a Republican idea, it is also the primary source of the modern conservative freakouts about how the poor aren’t paying any taxes.

When TRAC analyzes IRS audits, they find, generally speaking, the following:

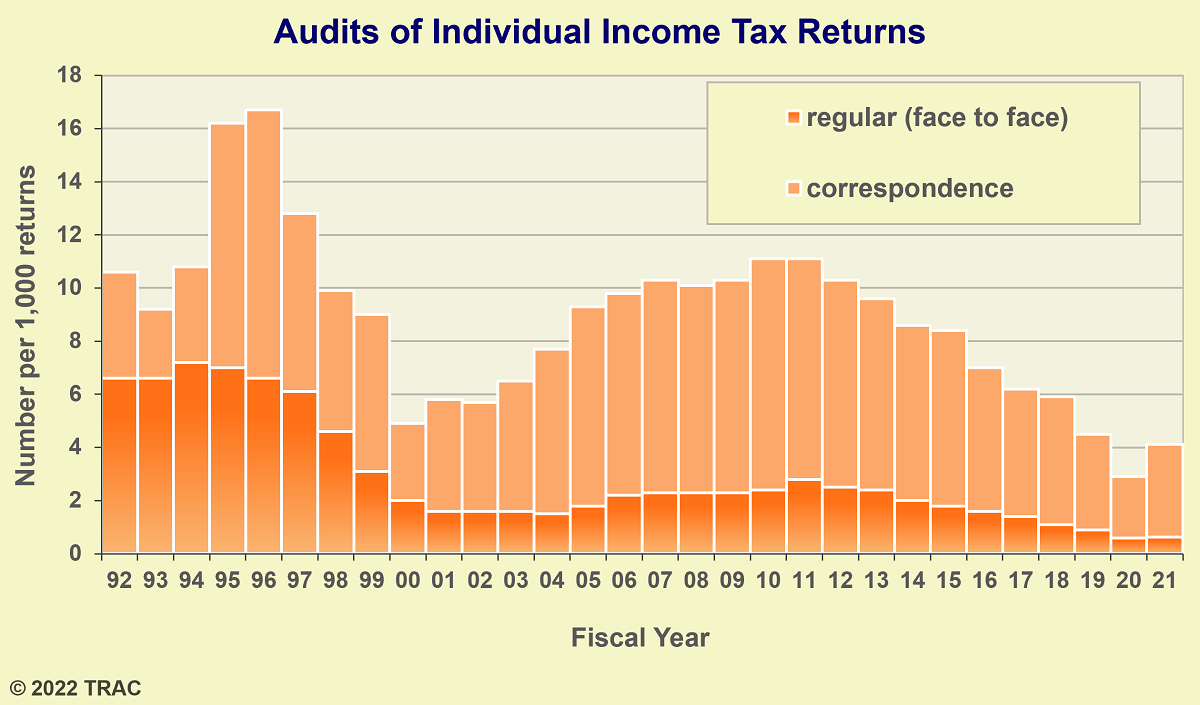

The IRS audits poor people five times more often than everyone else,

The reason for this is the IRS’s reliance on “correspondence audits,” where they basically send you a cryptic letter demanding more information which is very often confusing to the people who receive the letter,

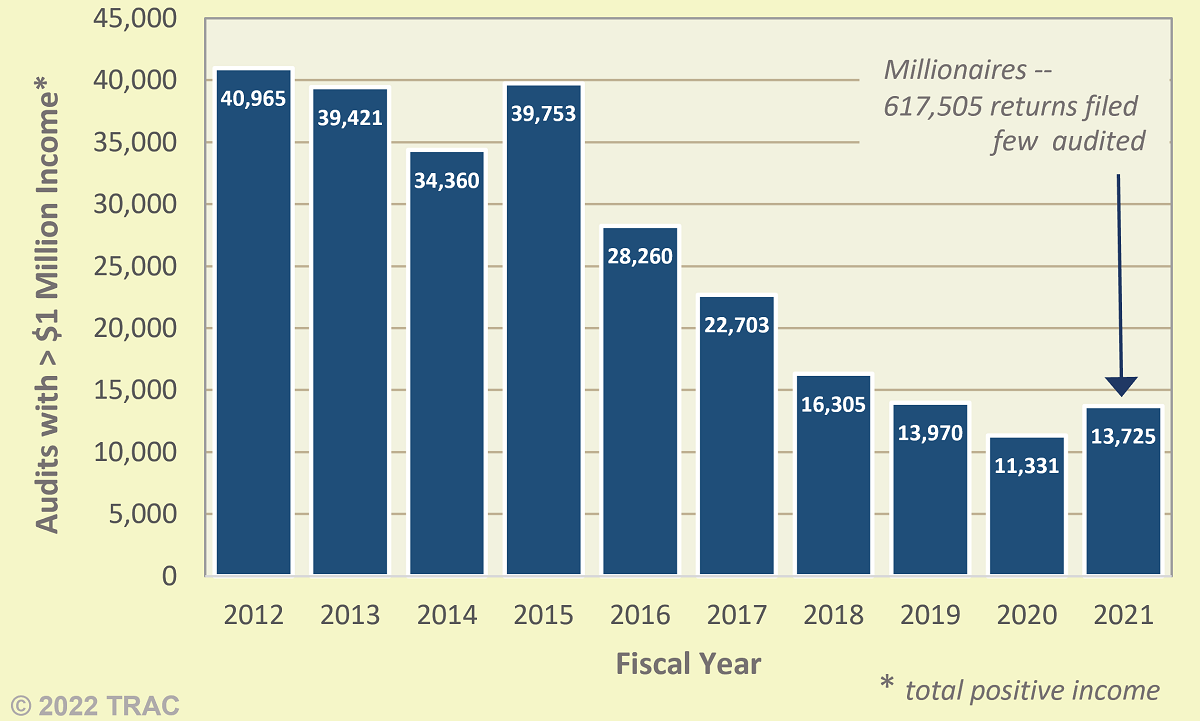

The millionaires aren’t being audited, quite possibly because millionaires can afford to hire a tax accountant to make sure everything’s filed properly,

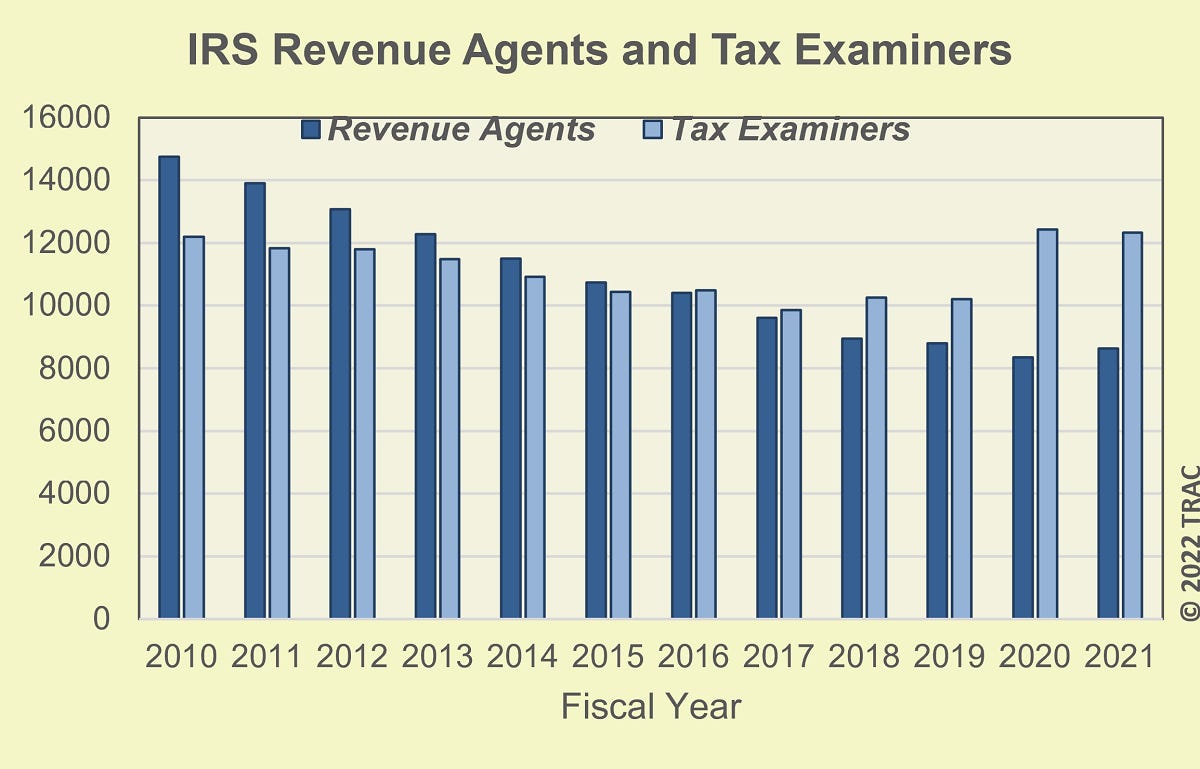

They claim that the reason is because the IRS is leaning heavily on “tax examiners” instead of “revenue agents,” the implication being that the IRS is hiring people who aren’t all that sharp and the IRS is not training them to do complicated audit procedures, so they tend to target easy targets.

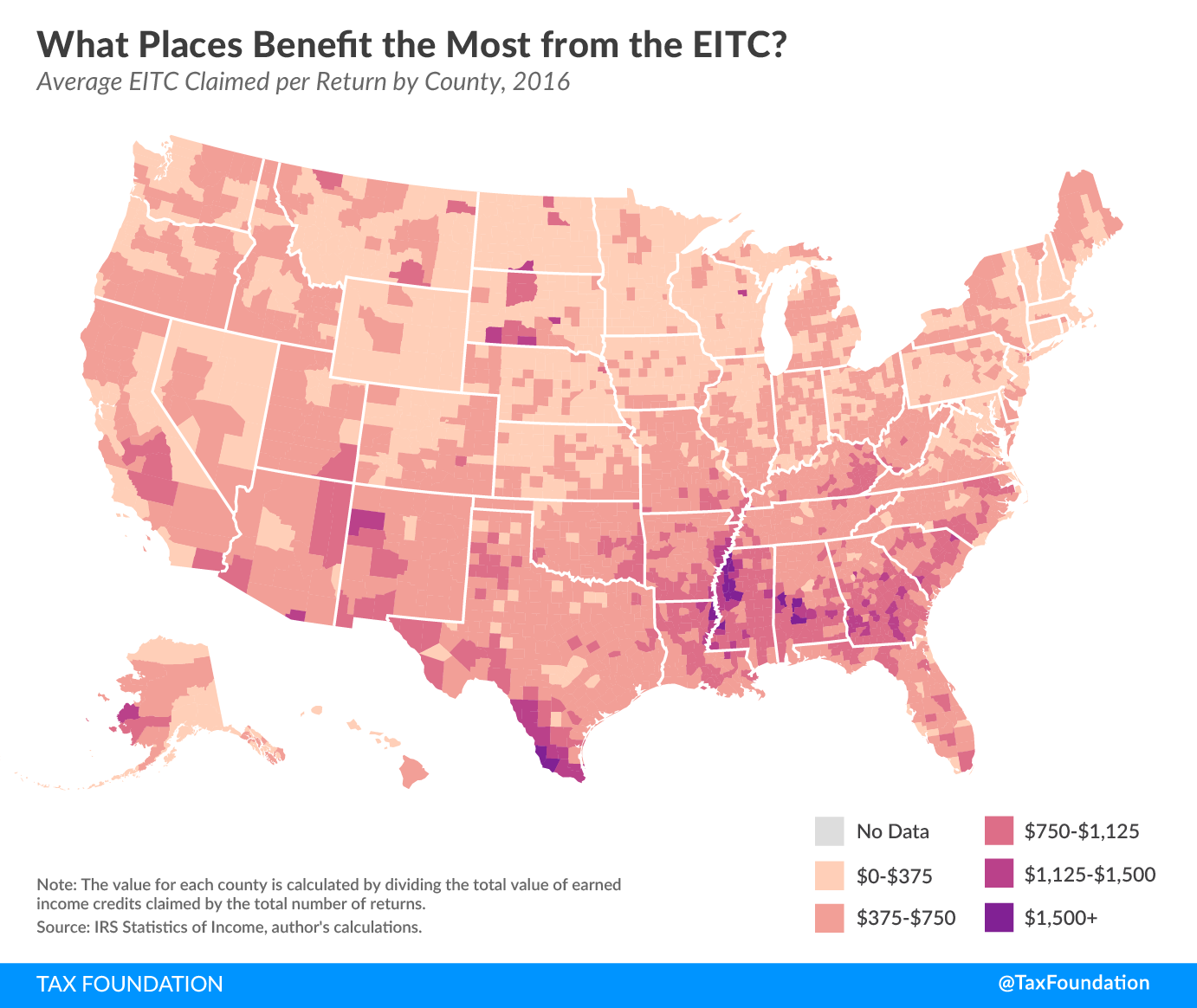

And this result, at its face, is born out in the maps. Taxfoundation.org has a map on their EITC explanation page, which looks like this:

Analysis of this map plugs the racial map hole in Western Kentucky and northern Tennessee, and also shows that the disproportionately Hispanic areas of northern Nevada are not heavy EITC users for some reason. It seems very likely from these maps and charts that the entire source of disproportionate IRS enforcement against the poor is how EITC applications are flagged within their system.

Racism

The definitions of racism in modern parlance are very confusing, and HWFO has released several primers on the subject, most recently this one, which identifies five wholly distinct versions of the word:

Individual racial prejudice

“Prejudice plus power”

Socioeconomic and government systems which produce differential racial outcomes

The universal impact of society wide subconscious racial bias

The actual belief that one race is genetically superior to another

All of these definitions are hotly debated, every racial debate HWFO observes sees interlocutors hot-swapping the definitions around in a confusing way, and HWFO does not ever engage in discussions about racism without clarifying exactly which definition we’re using. Definitions (3) and (4) in particular are often both termed “systemic racism” by the modern progressive left, and are used interchangeably when they are very different concepts. For the purposes of this article, we will focus narrowly on definition (3).

The IRS is a government system. It’s hiring practices are a system. How it flags returns for audits is a system. Who it audits are a result of the intersection of those systems. And the result of that nested layer of systems produces a differential racial outcome in audit ratio, because of population level racial income disparities.

If you are the kind of person who believes in '“systemic racism” as defined, and who fights against it, you must therefore conclude that the IRS is systemically racist and therefore must fight against the IRS if you value intellectual consistency.

Is the Inflation Reduction Act Racist?

It depends on what you expect to happen with the $80 billion earmark. Time Magazine’s “fact check” on the 87,000 number indicates that due to anticipated attrition the entire number may “only” lead to the addition of 20,000 to 30,000 total employees. Further, that addition may put the total IRS staffing at around where it was in 2013, close to 100,000. Treasury Department representatives claim that the hiring will be focused on IT, for instance getting the agency off of outdated COBOL systems, and on hiring professionals capable of doing more than “correspondence audits.”

Is this true? Maybe. Maybe not.

If these sorts of priorities were, as they claim, the sorts of things that can increase collections by 200 billion and target wealthier folks who are actually cheating, then why weren’t the resources they had available funneled into this purpose already? A sensible person may have decided “hey, let’s quit auditing all the black folks and go for the fat cats.” Without some sort of provision forcing the agency to make these structural changes, it’s quite likely it will continue to do what it already does, only more so. And if there’s opportunity to focus on the fat cats, why wasn’t that opportunity being exploited before? All they’d have to do is audit the poor less, and they chose not to do so before.

It seems from the outside that there is a specific audit criteria in place that flags EITC applications disproportionately. All that would be needed to fix the systemic racism in the system is to change that criteria. Hell, they could even just put all the EITC flags in a pile and decide as an agency to only audit half the flags, and spend all the time they’d save auditing someone else. Such a system as that is so simple it could be implemented in a day.

When such a solution is that simple, and has not been implemented, I shall remain skeptical that the $80 billion earmark is going to fix much if anything.

And so should everyone else.

I've been doing taxes seasonally for a few years now. We desperately need more folks at the IRS as you simply cannot get through to a human being anymore. Congress also needs to stop fiddling with the tax code every year. The Trump administration made things so much more convoluted for businesses especially. These tax cuts are scheduled to sunset in 2025 and the industry is waiting with bated breath to see if they are made permanent.

Given all these constant tax code changes and inability to resolve tax issues in a timely way due to chronic underfunding of the IRS, the tax preparation industry is struggling to recruit and retain employees. As a result, many high-maintenance clients get dropped by their accounting firms every year. This also ends up being an equity issue as the lower income folks cannot find representation when the IRS comes knocking. Then you have the bottom-feeder fly-by-night tax prep operations luring naive or willfully blind folks with tax refund advances for shoddy or even fraudulent work. A LOT of the IRS cases are outright fraud committed not necessarily by the taxpayer - they are just rubes sucked in to the idea of fast, easy money by charlatans who file false returns on their behalf. There is also plenty of fraud committed by taxpayers themselves and I have had to turn away potential clients who wanted me to fib to the IRS on their behalf. Its a jungle out there!

Tax enforcement of EITC and Law enforcement of Drugs is the same racket. Easy targets, easy prosecution and the staffers rack up the stats and have evidence of "doing their jobs". Good policing and good tax enforcement, going after the REAL criminals, is incredibly difficult and a lot of times yields nothing.